Alex Merk wrote the following:

October 4, 2016

The end of U.S. dollar dominance may be unfolding in front of our eyes. No, we don’t think China’s ascent is the key threat; instead, key to understanding the U.S. dollar may be to understand the money market fund you might hold. Let me explain what’s unfolding in front of our eyes, and what it might mean for the U.S. dollar and global markets.

Typically, when we think about potential threats to the dollar, we think a different reserve currency might take over; or that foreigners might dump their dollar holdings. …

Foreigners holding U.S. debt

Yes, foreigners hold trillions in U.S. debt, and if they were to dump all their debt, borrowing cost in the U.S. might rise. Except it hasn’t happened: in our analysis, as foreigners have been selling U.S. Treasuries, the dollar has neither plunged, nor have U.S. borrowing costs skyrocketed. Why is that? As we will discuss below, we believe, in the short-term, other market forces have been even stronger. …

Some say the inclusion of China’s currency into the official basket of reserve currencies (SDRs) by the International Monetary Fund (IMF) is a clear sign that we have the beginning of the end of dollar dominance. In our assessment, this change is mostly symbolic. …

End of Dollar Dominance?

If our analysis is correct and there has been a massive subsidy to borrow in U.S. dollars through the old money market fund rules, then we believe this helps explain why so many borrowers wanted to get their funding in U.S. dollars. No wonder the U.S. dollar was so popular when you got a free lunch. …

I use words like “may” and “might” not only because there are other scenarios. If I am not mistaken, for example, the U.S. cannot really afford much higher interest rates, especially if I look at the trajectory of U.S. deficits. As such, it’s quite possible that the Federal Reserve may keep borrowing rates low. But I am a firm believer that there will be a valve; that valve may well be the U.S. dollar, which may decline in the process. http://www.zerohedge.com/news/2016-10-04/end-dollar-dominance-axel-merk-warns-other-elephant-room

I agree that the current impact of the Chinese currency in the SDRs is currently mostly symbolic. But it was partially done to reduce the dominance of the dollar of the USA.

And yes, I also agree that there are many factors affecting the USA dollar, and that many foreigners are supporting the USA dollars now for reasons that are more internal, and not related to be actual strength of the USA’s currency.

So, there will be delays in the USA losing its dominance.

I would add that once interest rates rise substantially, this will be devastating for the USA.

Furthermore, when the Federal Reserve is unable to keep creating counterfeit dollars essentially by fiat that foreigners will take, it will be game over for the USA.

Economist Jim Rickards has pointed to the IMF and the destruction of the USA dollar:

A Timetable for the Dollar’s Demise

…

- On Oct. 7, the IMF holds its annual meeting in Washington, D.C.

You might be tempted to dismiss this calendar as “business as usual.” … The IMF has global meetings twice a year (spring and fall). But it’s not business as usual. This time is different.

The hidden agenda involves the formal transition from a dollar standard to an SDR standard in world monetary affairs. It won’t happen overnight, but the elite decisions and seal of approval will take place at these meetings.

The SDR is a source of potentially unlimited global liquidity. That’s why SDRs were invented in 1969 (when the world was seeking alternatives to the dollar), and that’s why they will be used in the imminent future. …

On Oct. 7, 2016, the IMF will hold its annual meeting in Washington, D.C., to consider additional steps to expand the role of SDRs and make China an integral part of the new world money order.

Over the next several years, we will see the issuance of SDRs to transnational organizations, such as the U.N. and World Bank, to be spent on climate change infrastructure and other elite pet projects outside the supervision of any democratically elected bodies. (I call this the New Blueprint for Worldwide Inflation.)

Thereafter, the international monetary elite will await the next global liquidity crisis. When that crisis arrives, there will be massive issuances of SDRs to return liquidity to the world and cause global inflation. The result will be the end of the dollar as the leading global reserve currency.

Based on past practice, we can expect that the dollar will be devalued by 50–80% in the coming years.http://dailyreckoning.com/timetable-dollars-demise/

Once the USA does lose its status as the world’s reserve currency, the USA will experience problems 99% of Americans probably do not think is possible.

As well as, or worse, than Jim Rickards or Alex Merk imagines–one day the USA dollar will lose 100% of its value. It will only be worth the dross in its coinage and whatever its cotton-paper currency is worth as trash.

The Bible also has an end time prophecy that those who read it may want to run:

2 Then the Lord answered me and said:

“Write the vision

And make it plain on tablets,

That he may run who reads it.

3 For the vision is yet for an appointed time;

But at the end it will speak, and it will not lie. (Habakkuk 2:2-3)

What is this end time prophecy about that should cause people to run? It is a prophecy about debt accumulation:

6 “Will not all these take up a proverb against him,

And a taunting riddle against him, and say,

‘Woe to him who increases

What is not his — how long?

And to him who loads himself with many pledges’?

7 Will not your creditors rise up suddenly?

Will they not awaken who oppress you?

And you will become their booty.

8 Because you have plundered many nations,

All the remnant of the people shall plunder you (Habakkuk 2:6-8)

The USA is believed to be the most indebted nation in the history of the world. Habakkuk’s prophecy is for the end time and cannot be directed towards the tiny nation called Israel. Israel simply does not have enemy creditors. But the USA has actual, past, and potential enemies as creditors.

The time will come when foreign creditors will rise up. They will decide that the Federal Reserve tactics have been covering the truth that the USA dollar is not worth but a fraction of what many thought it was.

Consider that despite having misunderstandings of prophetic events, even secular sources are seeing that there is a trend to topple the USA as the world’s dominant economic power.

And, according to biblical prophecy that will happen–and it will be worse for the USA than what nearly all analysts believe is possible.

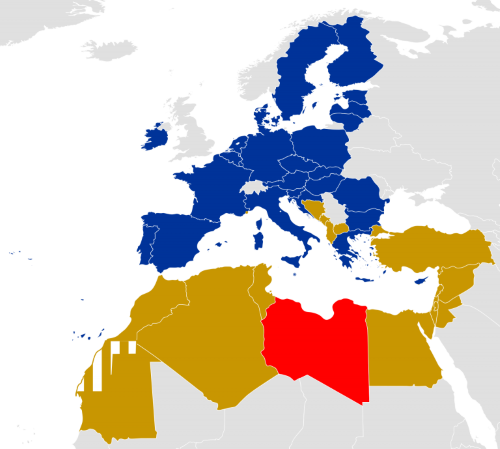

The Bible shows that a powerful international economic leader will arise (cf. Revelation 18) and it will NOT be the USA.

http://www.cogwriter.com/news/prophecy/end-of-us-dollar-dominance-or-delays/

News presenter: Bill Wedekind.

RELATED ITEMS

America's Day of Reckoning 2017 Dollar Collapse?

Collapse of the Euro and Dollar? War in 2020?

Can You Prove that the Beast to Come is European?

Military Technology and the Beast of Revelation

Can the Great Tribulation begin before 2020?

Six Financial Steps Leading to 666?

What is the 'Mark of the Antichrist'?

What is the 'Mark of the Beast'?

Ten Kings of Revelation and the Great Tribulation

Is World War III About to Begin? Can You Escape?

Market Collapse then New World Order in 2015?

Where are the Ten Lost Tribes? Why does it matter?

Are the Snowden NSA leaks leading to the destruction of the USA?