Are governments around the world moving towards eliminating cash to have ‘cashless’ societies? A reader sent me the following, dated 12/03/15, that suggests that may be the case:

Are You Safe from the War on Cash?

Governments are waging a war on cash…

Although you won’t hear it in the mainstream media, many world governments want to eliminate paper cash. Governments hate paper cash because it’s hard to track. Electronic payments through banks are much easier to monitor and record.

Nick Giambruno, editor of Crisis Speculator, has been following this trend closely.

The War on Cash is a favorite pet project of the economic central planners. They want to eliminate hand-to-hand currency so that governments can document, control, and tax everything. In just the last few years…

- Italy made cash transactions over €1,000 illegal;

- Switzerland proposed banning cash payments in excess of 100,000 francs;

- Russia banned cash transactions over $10,000;

- Spain banned cash transactions over €2,500;

- Mexico made cash payments of more than 200,000 pesos illegal;

- Uruguay banned cash transactions over $5,000; and

- France made cash transactions over €1,000 illegal, down from the previous limit of €3,000.

Nick went on to explain that the U.S. government imposes restrictions on withdrawing your own cash from the bank.

In the U.S., central planners ratchet up the War on Cash every time the government declares a made-up war on something else…a war on crime, a war on drugs, a war on poverty, a war on terror…

They all end with more government intrusion into your financial affairs.

Thanks to these made-up wars, the U.S. government is imposing an increasing number of regulations on cash transactions. Try withdrawing more than $10,000 in cash from your bank. They’ll treat you like a criminal or terrorist.

• We just got the clearest sign yet that paper cash is disappearing…

The world’s largest printer of banknotes (paper currency) is cutting production and firing employees.

Yesterday, De La Rue (LON: DLAR) announced it will cut its banknote production capacity by 25%. The company is closing half of its production lines and eliminating 300 jobs.

De La Rue prints more banknotes than any other company in the world. It produces banknotes for over 150 national currencies, including the British pound sterling. Its stock price is down 20% since mid-April.

The company’s CEO said the decision was made to keep the company “in line with the future needs of our global customers.” https://www.caseyresearch.com/articles/are-you-safe-from-the-war-on-cash

Notice also the following:

12/03/15

This week brought a further tell-tale sign of our changing world. De La Rue, one of the world’s oldest and largest bank note printers, announced it is cutting banknote capacity by a quarter.

The company has been struggling amid a global banknote glut. The move to cut the number of production lines from eight to four follows a slump in profits and a plunge in the shares – down more than half since 2013.

Tough for De La Rue. But is this just another casualty of digital technology that has decimated other industries – why need we lament? Who really wants to go back to the era when transfers between our accounts required a visit to the bank branch? What is more welcome than the ability to make such transfers walking along the street and pressing buttons on a mobile phone? What could be less sinister or threatening to our daily business?

But there is another altogether more profound change underway: a world without messy bank notes and the laborious process of cheque writing – but which could render us vulnerable to the digital swipe of central banks and governments. Indeed government control of our savings and wealth – far greater than any intrusion by HMRC or the VAT inspector – is now technologically possible.

There is evidence all around of the push towards cashless payment. …

Tim Price has been ringing the alarm bells on the wider consequences of this policy. …Price is not sounding a lament for the disappearing world of bank notes and cheque books. What worries him is that complete abolition of cash threatens our individual freedoms and rights.

“I’m sure”, he writes, “you’ve noticed this quiet coercion… rewards for using debit and credit cards… closed cashier windows on the underground forcing you to use the machines, raising the contactless payment limit to £30, phone apps that let you digitally transfer money at a push of a button.

“The authorities are associating cash with being old-fashioned, behind the times. They are trying to introduce a social stigma around it and humiliate every ‘poor old sap’ fumbling for change at the supermarket. This is a deliberate ploy to usher in an era of total control over your money and life.” http://www.scotsman.com/news/bill-jamieson-cashless-world-will-erode-civil-liberties-1-3965122#ixzz3tr6KgQ64

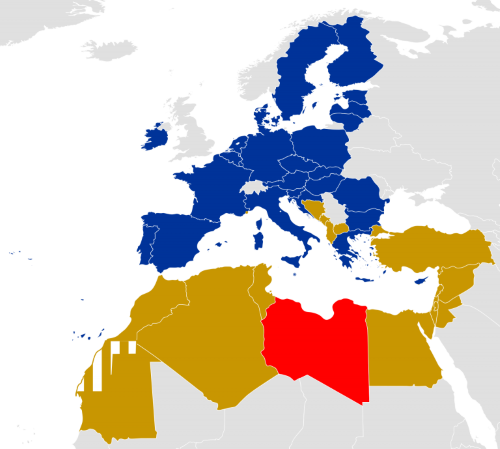

I have reported on this move towards cashlessness before from other sources (see, for example, M&M & CNN: European and other governments pushing towards cashless society where 666 can operate).

The reality is that electronic currency is easier for countries to control and even confiscate.

And it is not only a few governments that want this. Notice that CNN reported that the United Nations trying to get the world to go cashless:

Even the United Nations, alongside the Bill and Melinda Gates Foundation, wants societies to forego cash for more virtual transacting. It wants to cut costs and improve transparency, and is working with governments and the private sector to encourage more use of electronic payments. (http://money.cnn.com/2015/06/02/technology/cashless-society-denmark/)

But what about the USA? Well, in California, there already is an electronic welfare card that replaced what are called ‘food stamps.’

For decades the USA has been pushing first to pay its employees, then those who receive various government payments (like social security) electronically.

While the USA does allow cash transactions, it has certain restrictions and reporting requirements related to cash–and it requires banks to report those who might use cash suspiciously. In addition, the USA is getting many banks around the world to comply with its FATCA regulations, which are designed to eliminate any financial privacy around the world (for USA residents and citizens). The pushing of these rules is helping set up a banking monitoring system that the Europeans will also likely use (see also ‘The Coming Death of the Dollar’). The USA, though NOT 666, is helping set the stage for 666.

RELATED ITEMS

M&M & CNN: European and other governments pushing towards cashless society where 666 can operate

Alternative to the US Dollar in the Fall of 2015?

The 'Harbinger' and September 2015

Can the Great Tribulation Start in 2016?

Can You Prove that the Beast to Come is European?