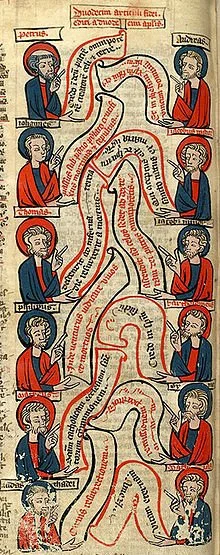

Chinese currency notes

As expected (see IMF expecting to add China’s currency–another step in the replacement of the US dollar?), the International Monetary Fund added China’s currency to its basket:

November 30, 2015

The Chinese yuan traded higher offshore as the International Monetary Fund decided to include it in a basket of reserve currencies, a move that will integrate the country into to a global financial system dominated for decades by the U.S., Europe and Japan. http://www.bloomberg.com/news/articles/2015-11-30/offshore-yuan-advances-on-intervention-bets-before-imf-decision

November 30, 2015

The decision means that the renminbi, also known as the yuan, will join the U.S. dollar, the Japanese yen, the Euro and the British pound as one of the currencies that the IMF uses to denominate its loans.

That will create modest demand for the yuan, but more important is the prestige factor: The IMF’s stamp of approval gives the world’s second-largest economy new credibility in the financial markets, allowing it to be used more widely in trade and financial transactions.

The move “is an important milestone in the integration of the Chinese economy into the global financial system,” IMF Managing Director Christine Lagarde said in a statement. She added:

“It is also a recognition of the progress that the Chinese authorities have made in the past years in reforming China’s monetary and financial systems. The continuation and deepening of these efforts will bring about a more robust international monetary and financial system, which in turn will support the growth and stability of China and the global economy.”

…The New York Times reports that the inclusion of the yuan introduces new uncertainty into China’s economy and financial system, “as the country was forced to relax many currency controls to meet the I.M.F. requirements”:http://www.npr.org/sections/thetwo-way/2015/11/30/457895104/chinas-renminbi-gets-a-stamp-of-approval-from-the-imf

Christine Lagarde went on record long ago that she wants to replace the dominance of the USA’s dollar as the world’s reserve currency. Adding the Chinese currency to the IMF’s basket basically is intended to reduce the world’s dependency on the USA’s dollar, while also providing China political recognition for agreeing to some financial changes.

China will have issues, and will NOT be the economic leader in this age (the Bible shows that Europe will in Revelation 13,17, & 18)...

News Presenter: John Hickey